It is critical to develop a financial plan for those with Alzheimer’s disease. Learn three helpful tips for getting started, and how to best organize important income, investment and liability records.

An Alzheimer’s diagnosis changes everything.

Ask Daisy Duarte, a 24-hour caregiver to her mom who has Alzheimer’s. Daisy and her mom are portrayed in the January 2017 PBS documentary “Alzheimer’s: Every Minute Counts.” When it was necessary, Daisy closed her business to become her mother’s fulltime caregiver. Together, they live on her mother’s pension, and income from Daisy’s part-time job.

Whether it be a family member quitting work and forgoing current and future income to become their loved one’s caregiver, moving a loved one to a memory care facility, or hiring in-home caregivers to provide care, the cost to both the one with Alzheimer’s, as well as to the caregiver, is great, and the journey is long.

Upon learning of an Alzheimer’s diagnosis, it is generally agreed that, when possible, it is important to begin preparing financially for the time when care will be needed. If it is early in the disease process, preparing early allows the one with Alzheimer’s to organize their documents, state their wishes for their care, and give their loved one’s clear guidance. In the long run, this planning and organizing makes it easier on everyone, and possibly saves money. If one waits too long while the disease progresses, it may be difficult for the one with Alzheimer’s to participate in the organizing and preparations.

After the Alzheimer’s Diagnosis: Getting the Financial Preparations Started

- What are the first three things a person should do to prepare financially when receiving an Alzheimer’s diagnosis

- Organize your financial information (cash flow, balance sheets) in a way that someone else can understand, in the event that you might need to share decision-making responsibility down the road.

- Decide who is appropriate to make decisions about property and health in the event that you are less able, and make sure your wishes are reflected in your legal documents.

- Collect information about how to plan for the most optimistic care needs, including how decisions will be made and how care will be paid for. Decisions about more comprehensive care needs can be done later.

Organizing your Financial Information

What financial information should you be organizing? The National Institute on Aging’s AgePage provides a comprehensive list of financial records you would want to pull together to provide a complete picture of your finances. Put this information in one place – a binder, a file, or a drawer – and you will make it easier for your appointed decision maker and/or power of attorney to follow through on your wishes and manage your affairs when you are unable to do so. Included in the list is:

Income and Asset Information

- Pension from your employer, IRAs, 401(k)s, interest, etc.

- Social Security, Medicare and Medicaid information

- Insurance information: life, health, long-term care, home and car – include policy numbers and agent’s names and phone numbers

- Bank names and account numbers for checking, savings and credit unions

Investment Income

- Stocks, bonds and property with stockbrokers’ names and phone numbers

- Copy of most recent income tax returns—state and federal

- Location of most up-to-date will with an original signature.

Liability Information

- Property tax: include what is owed, to whom and when payments are due

- Mortgages and debts – how and when they are paid

- Location of original deed of trust for home

- Car title and registration

- Credit and debit card names and numbers

- Location of your safe deposit box and key

Acknowledgment

Thomas West of Signature Estate Investment Advisors provided input regarding the three steps to prepare financially after a diagnosis of Alzheimer’s.

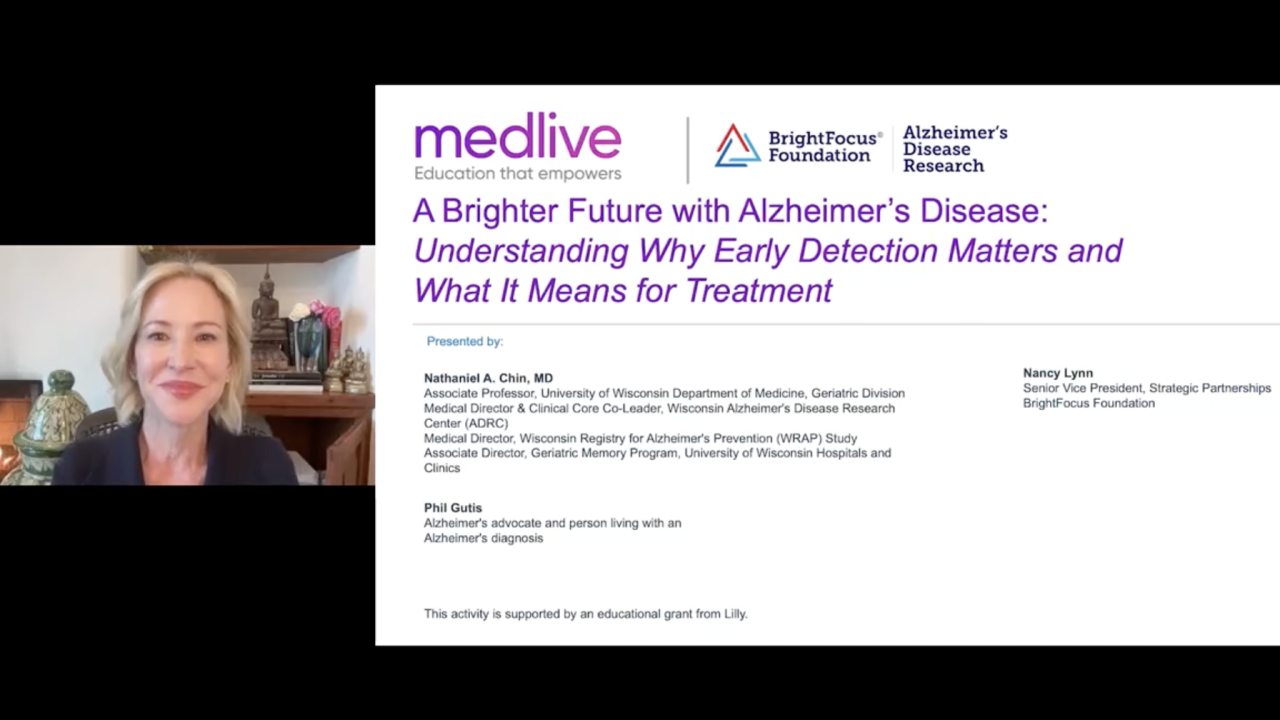

About BrightFocus Foundation

BrightFocus Foundation is a premier global nonprofit funder of research to defeat Alzheimer’s, macular degeneration, and glaucoma. Through its flagship research programs — Alzheimer’s Disease Research, Macular Degeneration Research, and National Glaucoma Research— the Foundation has awarded nearly $300 million in groundbreaking research funding over the past 51 years and shares the latest research findings, expert information, and resources to empower the millions impacted by these devastating diseases. Learn more at brightfocus.org.

Disclaimer: The information provided here is a public service of BrightFocus Foundation and is not intended to constitute medical advice. Please consult your physician for personalized medical, dietary, and/or exercise advice. Any medications or supplements should only be taken under medical supervision. BrightFocus Foundation does not endorse any medical products or therapies.